IBDS

Institute of Behavioural and Decision Science (行為與決策科學研究所)

Events

IBDS Seminar (Behavioural Finance) - New Investors

- July 20, 2022 (Wednesday)

- 10:00am - 11:30am

- Room 301, K.K. Leung Building, HKU

- Hybrid

Dr. Zhenyu Gao

Associate Professor,

Department of Finance,

The Chinese University of Hong Kong

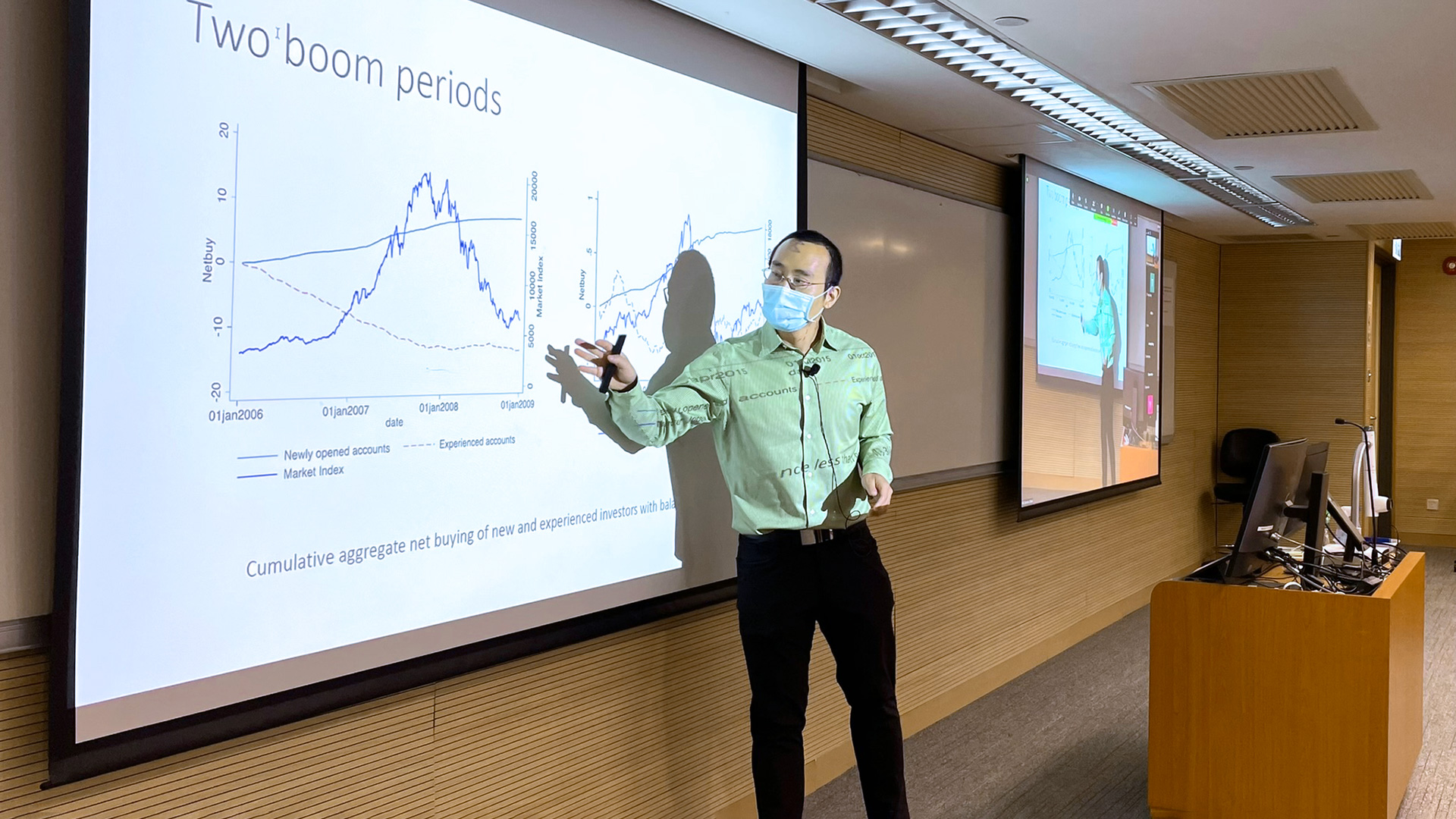

Using account-level data of the Shenzhen Stock Exchange from 2005 to 2019, we identify new investors without any previous trading experience and find that their entries and net buying negatively predict both market and cross-sectional stock returns. New investors tend to trade against more sophisticated investors, including institutional and experienced retail investors. Their behaviors could partially explain several known anomalies in the Chinese stock market, while other retail investors’ trading could not. We provide evidence that several China-specific phenomena, such as daily momentum and price overshooting around stock splits, are driven by new investors. We show the vast heterogeneity of retail investors, who are traditionally regarded as noise traders, and suggest new investors’ activities as a more accurate measure of noise trading.