IBDS

Institute of Behavioural and Decision Science (行為與決策科學研究所)

Events

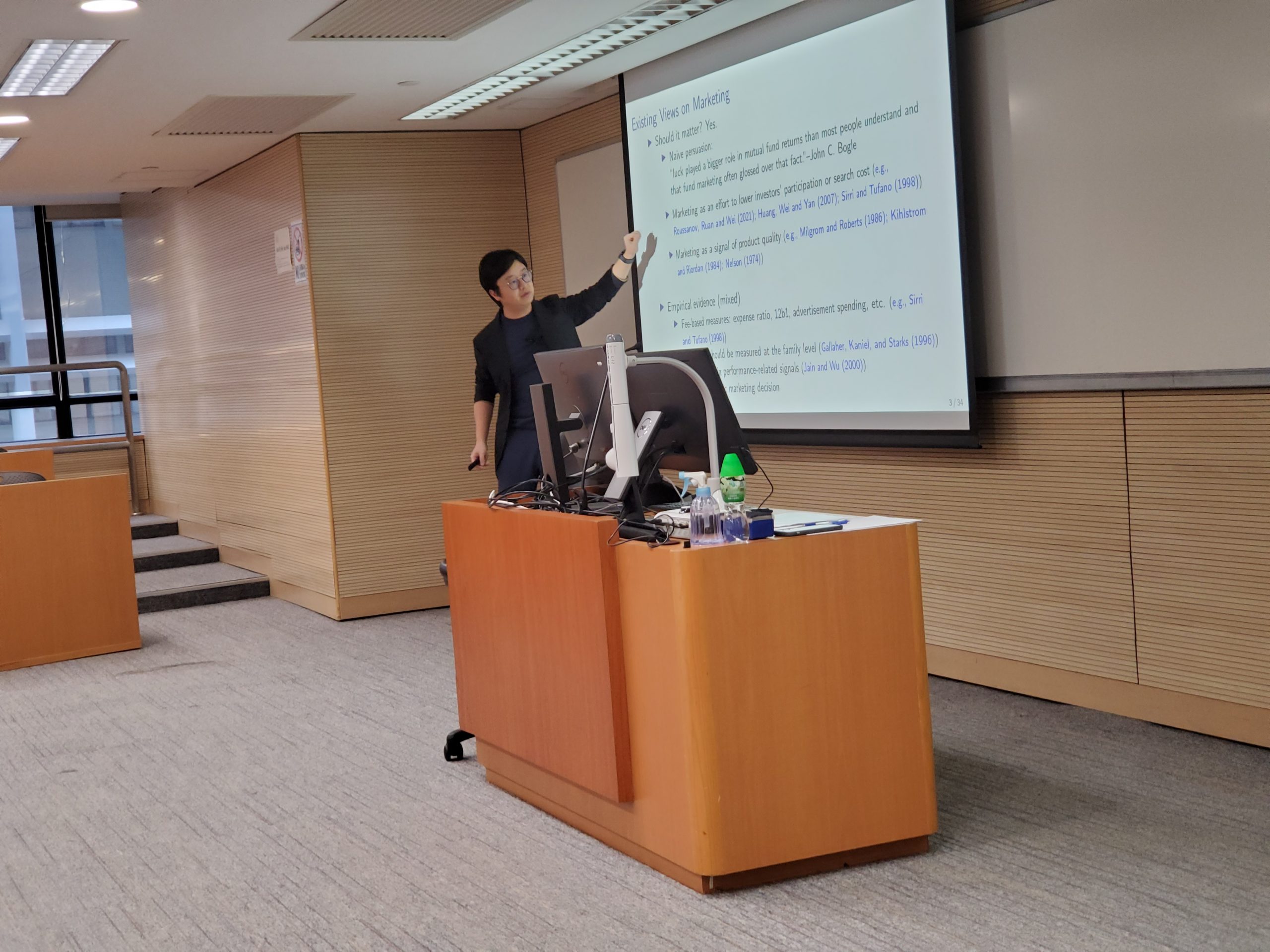

IBDS Seminar - The Economics of Mutual Fund Marketing

- March 13, 2023 (Monday)

- 10:30 a.m. – 12:00 p.m.

- Room 315. K.K. Leung Building, HKU

- Hybrid

Speaker:

Prof. Wenxi (Griffin) Jiang

Associate Professor, Department of Finance, CUHK Business School

Abstract:

We uncover a significant relationship between the persistence of marketing employment strategy and fund performance in the U.S. mutual fund industry. Using regulatory filings, we show a large heterogeneity in fund companies' marketing employment share, the share of employment devoted to marketing and sales. Not only that the marketing employment share increases in family size and predicts subsequent fund flows, but it is also persistent across fund families. A framework based on Bayesian persuasion and costly learning helps to explain the observed strategic marketing decision. As the optimal marketing plan, fund companies with different skill types commit to heterogeneous marketing employment strategies: conditional on the skill level, fund companies' optimal marketing employment share responds to their past performance differently. Low-skill funds only conduct marketing following good-enough past performance, while high-skill funds maintain a high marketing employment share even with very poor past performance. Consistent with the model prediction, we show that the volatility of the marketing ratio is negatively correlated with the long-term performance of fund companies.